Solar Growth Continues as Suniva Case Looms

Friday, Jun 09 2017

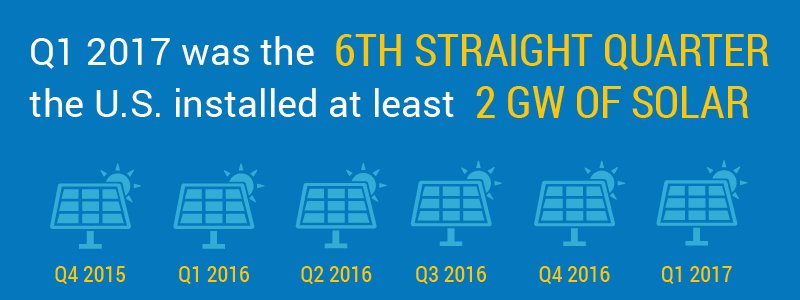

There is never a dull moment in the solar industry, but one thing that has been consistent is growth. The SEIA and GTM Research Q2 2017 U.S. Solar Market Insight report shows just that. The U.S. solar industry added more than 2,044 megawatts of new capacity in the first quarter of this year, marking the sixth straight quarter in which more than two gigawatts of solar was installed.

Solar is a true American success story, and that is reflected in this report. However, this growth is imperiled by Suniva’s active Section 201 trade petition with the International Trade Commission. This blunt instrument will cost tens of thousands of American jobs, if high tariffs are imposed as suggested, and in turn, bring solar growth to a screeching halt.

In effect, Suniva, a bankrupt Georgia company owned by the Chinese, and SolarWorld, whose German parent company is insolvent are seeking economic relief from more competitive panels from other parts of the world. This is the wrong way to revive American panel and cell manufacturing, which we are determined to do, to say nothing of the 38,000 other manufacturing jobs in the solar sector threatened by this petition. And we are doing everything we can to oppose it.

The trade case aside, a number of variables factored into the numbers in the market report, including projects in the pipeline as 2015’s planned ITC expiration approached, the overall economy, new markets opening, etc. And through it all, solar was second only to natural gas as the largest source of new electric generating capacity brought on-line, responsible for 30 percent of added generation.

This impressive macro-level growth is just a sliver in an array of positive storylines from this SMI report. Developments in markets like community solar are bright spots for the ever-growing solar industry, specifically in Minnesota which nearly doubled its cumulative community solar capacity in Q1.

States such as Utah, Texas and South Carolina continue to scale in the residential sector and are growing into significant national solar players. New York was welcomed into the “Solar Gigawatt Club,” as all top 10 solar states now have more than one gigawatt of capacity installed.

All of these narratives fit into what was another strong Q1 for our industry. The progress made, though, can be boiled down to one big milestone. For the first time ever, utility-scale solar prices fell below $1.00 per watt. This is particularly notable because, according to the U.S. Department of Energy, utility-scale solar system cost was not projected to fall under $1.00 per watt until the year 2020.

Utility-scale system prices are falling much faster than predicted and PV prices continue to drop across all market segments, falling 63 percent over the last five years.

SEIA and GTM Research forecast that 12.6 gigawatts will come online in 2017, just 10 percent less than 2016’s boom, when the market grew by 98 percent.

There is no question that the Suniva cloud threatens to pour cold water on the industry’s progress and we need your help to fight the battle and preserve solar’s growth. But if we can stop this ill-conceived effort to prop up underperformers, and with the right policies in place, U.S. solar capacity is expected to TRIPLE in size, to more than 128 gigawatts by 2022. By that time, more than 22 million American homes will be powered by solar.