2013 Policy Priorities- Federal & State

Support our workThe Solar Energy Industries Association is building a strong solar industry to power America by working at the federal and state levels to expand markets, remove market barriers, and increase available financing for solar projects.

Expand Markets

Government incentives, mandates and procurements all help to grow the solar energy market. Renewable portfolio standards (RPS) that include solar carve-outs and inclusion of solar heating and cooling technologies are proven policies that boost solar demand while diversifying state energy portfolios. Third-party financing and Power Purchase Agreements encourage investment and reduce risk. These financing models should be available for use across all 50 states.

Remove Market Barriers

Despite recent dramatic growth of the U.S. solar market, barriers to entry remain. Most critically, net metering programs providing compensation for solar customers for excess generation are under attack and must be protected. Trade barriers reduce competition and hinder a thriving international market. Simplifying siting and permitting processes, ensuring “fast track” interconnection standards, and reducing the burden of codes and standards will grow the solar industry.

Increase Available Financing

Smart tax policies like the Investment Tax Credit (ITC) are critical to lowering costs for customers and opening financing opportunities. Accelerated depreciation under the Modified Accelerated Cost Recovery System (MACRS) continues to drive job creation and industry growth by providing the market certainty needed for long-term investments. Defending existing funding sources and aiding in the creation of new forms of financing helps to ensure further industry innovation and growth.

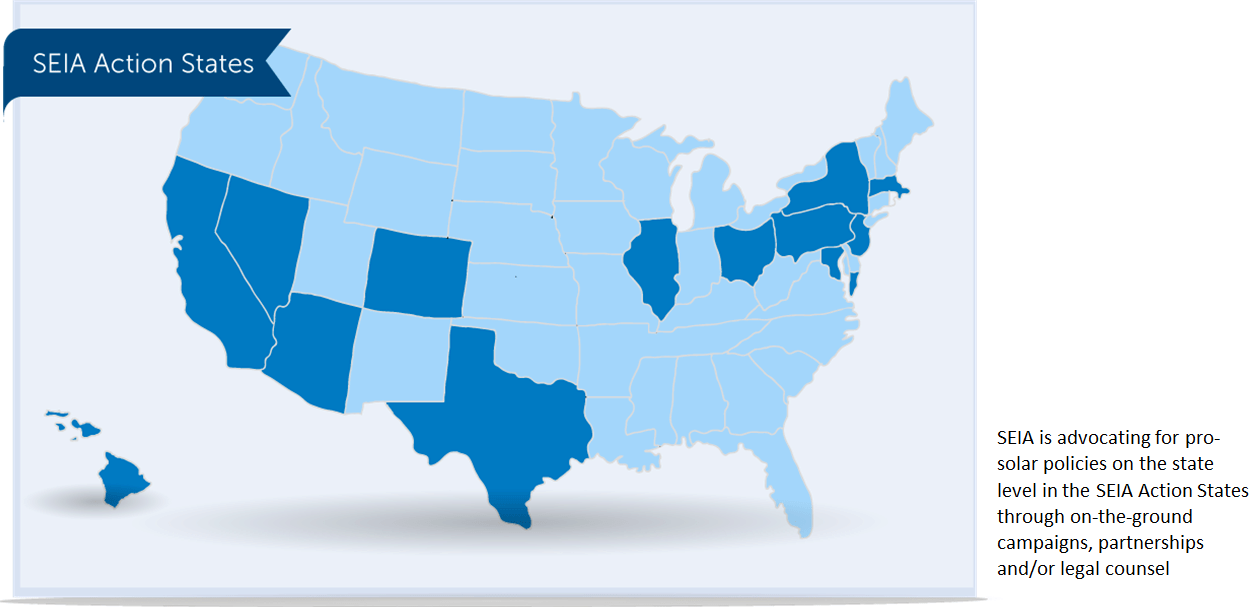

Learn More About Our State Solar Priorities

Policy Priorities in Detail

Federal

Smart Tax Policies

The Investment Tax Credit (ITC) is one of the most important federal policy mechanisms to support the deployment of solar energy in the U.S. From 2005, when the ITC was enacted, to the third quarter of 2012, the amount of solar installed in the U.S. grew by 77% annually. That’s a successful policy. The Modified Accelerated Cost Recovery System (MACRS) also continues to drive growth by providing more market certainty for investors. The ITC would create thousands more jobs and spur gigawatts of additional solar deployment if a “commence construction” provision were added to the credit. A “commence construction” standard, which other energy industries use effectively, would allow solar projects to qualify for the tax credit if they begin construction prior to the end of 2016.

Solar Projects as an Eligible Public Welfare Investment

Under existing federal law, all national banks may invest in projects designed to promote public welfare. In some cases, a solar energy project can be a qualified investment, yet many banks are hesitant to commit time and resources to use this authority due to regulatory uncertainty about project eligibility. Streamlining the regulatory process for qualifying solar energy projects and educating banks and solar companies about the process will help solar projects take advantage of the cost savings offered by public welfare investments.

FERC Rules Governing Solar Connections to the Electric Grid

In 2005, FERC issued Order No. 2006, which for the first time established national interconnection procedures for generation projects less than 20 megawatts. The solar industry has grown dramatically since then and the current rules include unnecessary barriers. SEIA filed a petition with FERC to allow solar projects to qualify for a “fast track” interconnection process, eliminating the need for costly and time-consuming studies, and doubling the amount of solar applications. In addition, SEIA will continue to support the work FERC has undertaken to improve the grid’s capabilities to improve the supply and delivery of electricity from renewable energy technologies and solve solar integration challenges through reasonable, low-cost efforts.

Alternatives to International Trade Litigation

Escalating international trade conflicts could have broad implications as the world is on the cusp of widespread adoption of solar. Therefore, SEIA is actively working to build consensus on government best practices, including acceptable forms of industry support, and to decrease trade barriers that negatively impact the free flow of solar products around the world.

State

Renewable Portfolio Standards

Renewable portfolio standards (RPS) have been key to growing utility-scale solar in the U.S. More than half of all states have a RPS or renewable energy standard (RES), which vary widely. Some states include more specific requirements (called carve-outs), which further incentivize the deployment of particular market segments or energy technologies. The solar industry works to expand solar carve-outs and new RPS policies as well as defend existing RPS policies against legal challenges.Net Metering and Rate Design Best Practices

Net energy metering (NEM) policies are critical to advancing distributed generation (DG). These policies have allowed residential and commercial solar installations to flourish in states like Arizona, California, Colorado, Massachusetts and New Jersey. Now, many NEM policies are under attack. The solar industry is defending existing NEM policies to protect American consumers’ solar investments while collaboratively developing “next generation” net metering policies and rate design best practices for solar customers and utilities.

Model Permitting and Interconnection

All Americans should be able to “go solar.” In many areas of the U.S., the permitting and interconnection process is unnecessarily complex, expensive and burdensome. States can foster the growth of solar energy by streamlining these processes and reducing the end cost to the consumer. The solar industry supports the Department of Energy’s efforts to cut red tape, and SEIA is actively engaged in formal proceedings in multiple states to reduce barriers.

Third-Party Financing and Power Purchase Agreements

In 2011, more residential solar systems in California were financed through third-party developers than through traditional cash purchases. These proven financing mechanisms lower costs, helping more American families and businesses choose solar. Third-party financing and other Innovative solar financing mechanisms should be allowed in all fifty states.