Solar Means Business 2013: Top U.S. Commercial Solar Users

In an increasingly competitive business landscape, some of the most well-run and efficient companies are turning to solar energy to stay ahead. From large corporations such as Walmart, Costco, Apple and IKEA to small, local companies, U.S. businesses are making significant investments in solar to cut energy costs. Solar allows businesses of all sizes and in a range of industries to lower their energy expenditures, improve their bottom line and gain a competitive advantage.

Businesses, including some of the most recognized brands in the U.S., have adopted solar at an unprecedented rate. Since the first edition of Solar Means Business was released last year, U.S. businesses, non-profits and government organizations have blanketed their rooftops and properties with over 1,000 megawatts (MW) of new photovoltaic (PV) solar installations.[1] As of mid-2013, cumulative commercial deployment totaled 3,380 MW at over 32,800 facilities throughout the country, an increase of more than 40 percent over last year.[2]

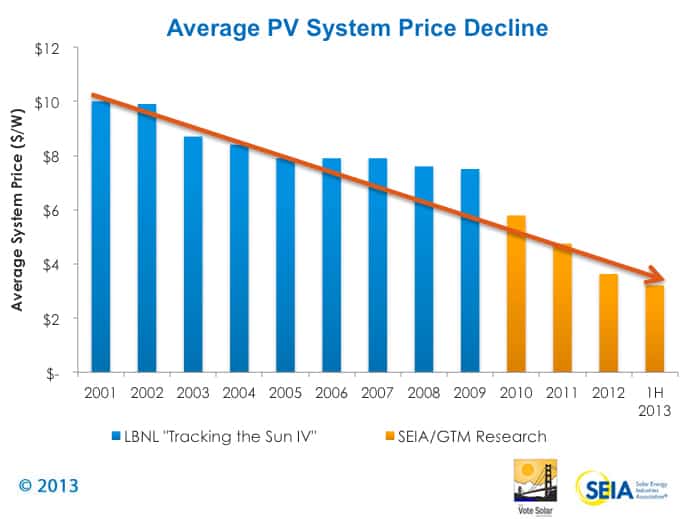

The consistent decline in the cost of PV systems has continued to improve the solar value proposition to commercial users. The average price of a completed commercial PV project has dropped by 30% since the beginning of the 2011 making solar more affordable than ever for American businesses. The dramatic fall in prices is encouraging more and more companies to open their investment portfolios to on-site solar energy systems.

This second edition of Solar Means Business, produced by the Solar Energy Industries Association (SEIA) and the Vote Solar Initiative (Vote Solar), chronicles the continued and growing deployment of the leading commercial solar users in the U.S. For this edition, researchers contacted all Fortune 100 companies,[3] as well as a number of additional businesses with known significant solar portfolios, to gather data.

Photo Gallery

Photo Gallery

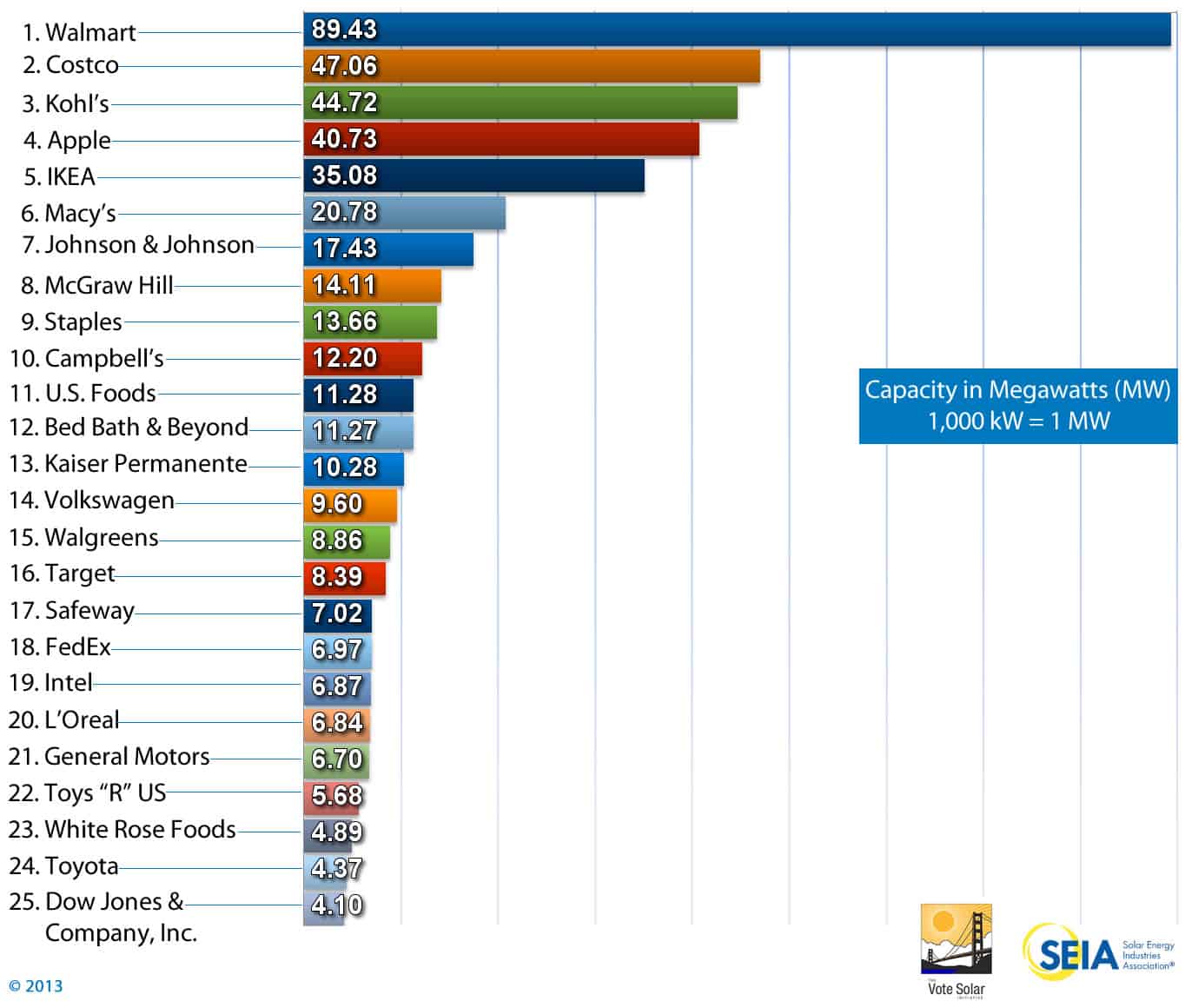

More than one out of every three Americans – 117 million people – live within 20 miles of at least one of the installations in the Solar Means Business Report. Explore photos of the installations at corporate retail sites, factories and data centers...see them allThe increased solar adoption by major corporations shown in this report reflects the growth displayed in the overall commercial solar sector over the last year. The 25 companies with the highest total solar capacity as of August 2013 have deployed more than 445 MW at over 950 different facilities, enough to power 73,400 American homes. This is up significantly from Solar Means Business 2012, in which the top 25 companies had installed just over 300 MW at 730 facilities.[4] This growth is occurring in new state markets as well. The companies analyzed for this report have deployed systems in 30 states and Puerto Rico. In fact, more than one out of every three Americans lives within 20 miles of at least one of these businesses’ solar installations. This growth is all the more impressive since several companies had already made significant commitments to solar in prior years (refer to Percent of Facilities Solar Powered section later in the report).

This year’s report not only ranks companies by the total installed capacity of their systems and the number of operating installations, but also shows the geographic diversity of their solar deployment. Solar Means Business 2013 includes a new section on commercial real estate developers’ solar activity as well.

Solar Is a Smart Investment for Business Leaders

In the eyes of some of the most iconic, well-managed companies, solar means business. For many companies, electricity costs represent the single largest operating expense. The continued fall in solar system prices and the adoption of innovated financing models that can reduce up-front costs allow companies that have deployed solar to dramatically reduce energy expenditures. In a growing number of markets, companies can either generate or purchase solar energy at or below local retail electricity rates, saving businesses money from “Day 1”.

Utility price volatility also presents a challenge to businesses’ long-term budgets. Solar allows companies to lock in fixed energy prices for decades. Whether the system is purchased upfront or financed through a Power Purchase Agreement (PPAs) or lease, solar offers long-term price visibility and a valuable hedge against rising and volatile conventional electricity rates. In addition, companies are learning that they can offset tax liability using the federal investment tax credit while powering their facilities as well.

An investment in solar allows American companies to reduce energy costs, allocate resources to their core business operations, and better plan for the future.

Top 25 Companies by Solar Capacity

American businesses have gone solar at an unprecedented rate in the past few years. The list below shows the massive investment leading companies have made in solar and ranks businesses by their total on-site solar installed capacity, or the maximum power potential measured in megawatts.

The 2013 rankings have expanded since the last edition of this report to include the Top 25 companies by capacity. While the list is made up of many of the same companies ranked last year, the new rankings show the growing solar portfolios of many of the country’s leading businesses and the continued development of the overall commercial market. The Top 25 companies have installed more than 445 MW of solar PV capacity across the country, up from about 300 MW last year.

Breakout Rankings

Solar is an attractive investment for companies in a range of industries. The rankings below show the leading solar commercial users by industry sector. While retailers have installed the most capacity, auto manufacturers, pharmaceuticals and food servicers as well as companies in many other industries, have all looked to solar to lower operating costs.

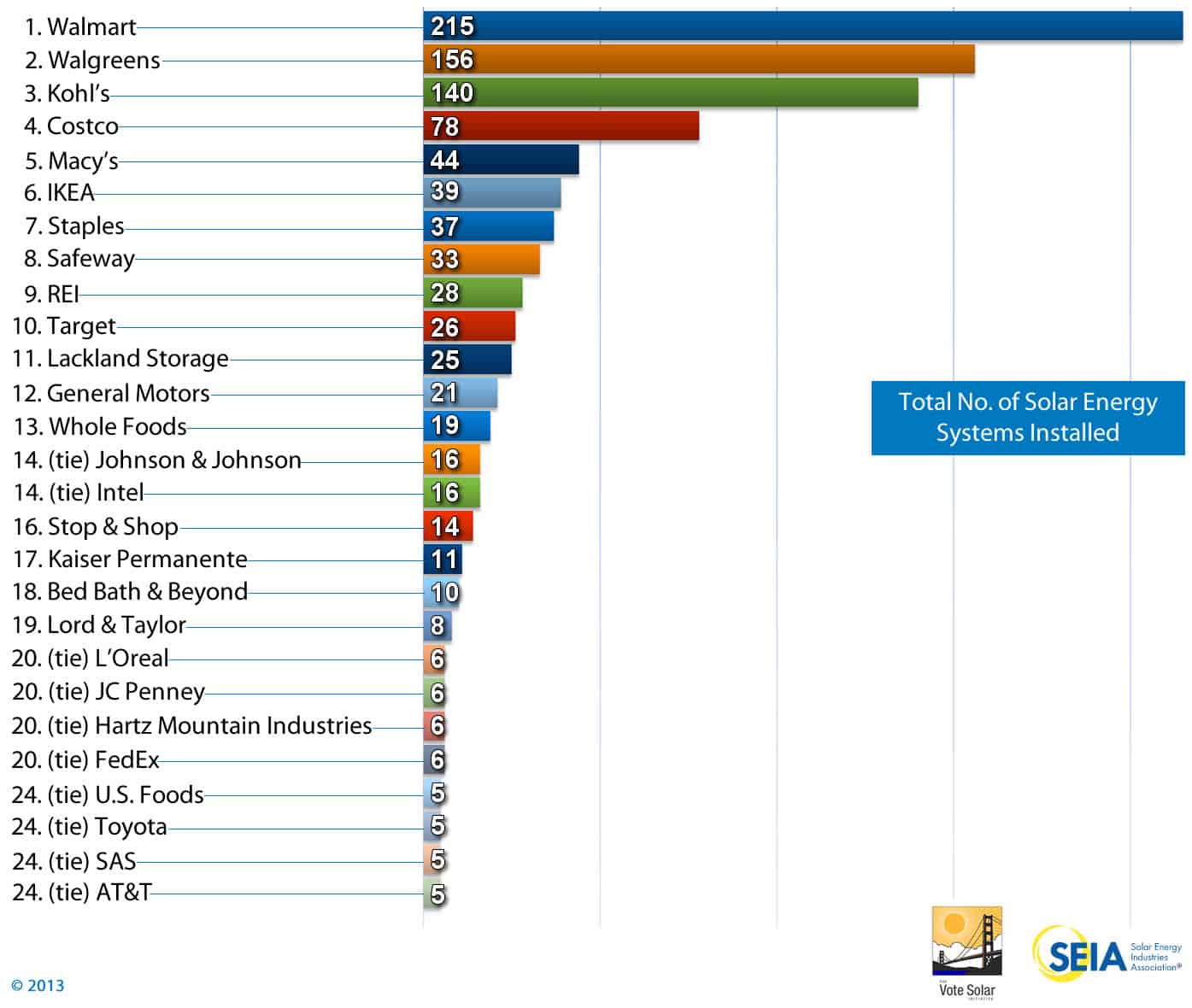

Top Companies by Number of Installations

The energy demands and load profiles vary significantly by company and by facility. In some cases, businesses have significant energy needs at one or two locations and install large solar arrays to help offset that demand. Other companies have multiple sites appropriate for solar and continue to install systems at facilities all across the country, building off the success of prior solar investments. One trend is evident —companies that have installed solar continue to add more. The list below ranks businesses by the number of their on-site solar installations. The Top 25 companies have installed more than 950 individual systems, a clear sign that solar meets a range of energy needs for a variety of different companies throughout the U.S.

Top Companies by Geographic Diversity

Top Companies by Geographic Diversity

The growth in the commercial market is not limited to only California, the largest state market for solar. Continued cost declines coupled with smart, effective policies have encouraged businesses to invest in solar in states across the country. In total, 117 million people in 30 states and Puerto Rico live within 20 miles of at least one of the 1,000 commercial solar installations that were analyzed in this report. The list below ranks businesses by the number of states in which they have installed PV systems at company facilities.

Interactive Map

As of Q2 2013, the cumulative commercial solar deployment totaled 3,380 MW, located at more than 32,800 facilities throughout the country. See where the top corporations in the U.S. have installed solar...see the map

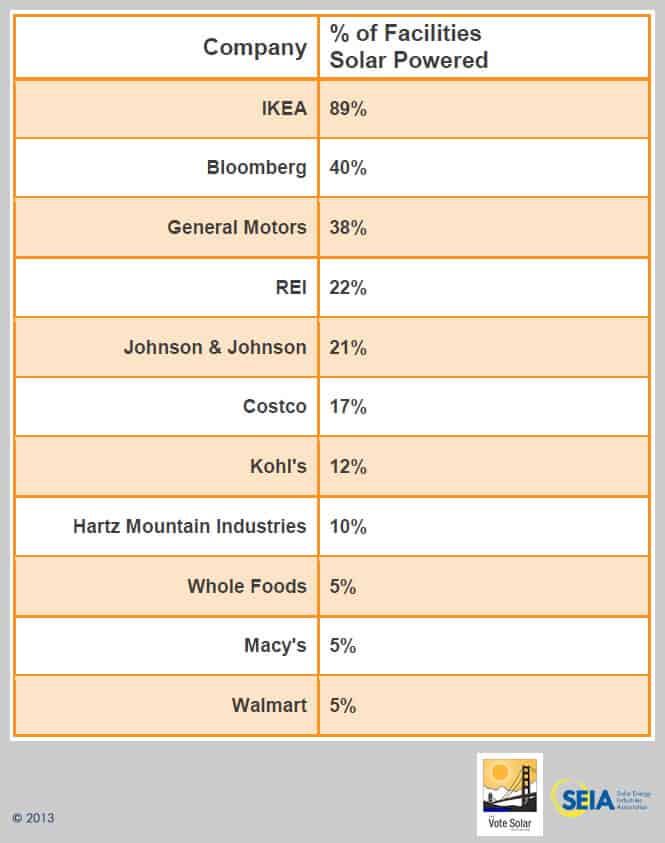

Top Solar Commercial Users by Percent of Solar-Powered Facilities

Some of the leading commercial solar users have made a massive commitment to solar, as evidenced by the data below. The figures show the usage rate of solar energy on company facilities for select businesses that ranked highly in both installed capacity and number of installations. Note that the list is not a full ranking, but rather is a comparison of some of the top commercial solar users in the report’s analysis. Many smaller companies with only one or two locations have solar at “all” of their facilities. With more than 32,000 commercial PV systems in the U.S., ranking all companies is not practical.

Commercial Investors Supporting Solar Growth

Many other companies have made massive investments in both utility and distributed generation solar. Google, Bank of America, Merrill Lynch and others have directly invested billions of dollars in the financing of solar energy installations across the country.

These types of investments are necessary for the continued development of both utility-scale solar and the availability of Third-Party Ownership (TPO) models, which allow homeowners and businesses to go solar at no-upfront cost.

Some companies have also implemented programs to encourage solar deployment at their customer’s homes. Specifically, Honda has established an investment fund with SolarCity to develop, finance and install systems at Honda customers’ residences.

While these investments have been critical for the solar market’s growth, they are beyond the scope of this research.

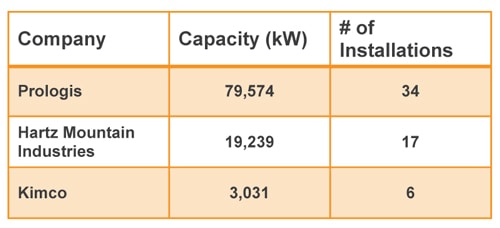

Commercial Real Estate Developers

The Solar Means Business 2013 rankings only include systems that supply power directly to company facilities on-site. Installations that either power facilities occupied by other tenants or sell electricity to utilities at the wholesale level are not included in this analysis.

The methodology therefore excludes the work of some real estate developers and investment trusts (REITs) that are extremely active in the solar market. Traditional commercial real estate developers and REITs have developed significant amounts of solar not accounted for in our rankings. These types of businesses often develop and/or own solar projects at their properties, but they do not consume the energy on-site themselves, rather utilities or their tenants use the electricity generated from their solar arrays. Developers have looked to utility off-takers when the solar potential of a given facility greatly exceeds the on-site energy demand. This is usually the case with warehouses and distribution centers that have large roof area but low electrical load. Real estate developers have also deployed solar at a range of commercial properties, including strip malls and big box retail outlets. Tenants of these facilities typically consume the energy generated from the solar installation on- site.

The list below shows the current solar portfolios of some of the leading real estate developers and REITs that have deployed solar at a significant scale. While these companies have a range of different types of installations at a variety of facilities, each viewed solar as a strong investment and a valuable way to utilize available roof space and land at their properties.

Methodology

SEIA and Vote Solar set out to rank the top corporate users of solar energy in the U.S. for the second year in a row. Researchers reached out to representatives at all Fortune 100 companies as well as a number of additional businesses and combed public databases to collect data. While every effort was made to collect complete and accurate data, not every company responded to our data requests and public databases do not capture all commercial installations. It should also be noted that new systems are commissioned every day. Ultimately, SEIA and Vote Solar believe this is an accurate portrayal of the leading commercial users of solar energy in the U.S. as of August 2013, but reserve the right to make adjustments as new data becomes available.

SEIA and Vote Solar only counted on-site PV systems that supplied power directly to company facilities for the rankings. This does not include utility PV power plants that sell wholesale electricity. While some companies purchase solar renewable energy credits (SRECs) from solar power generated off-site, this report does not consider such transactions due to limitations in data collection and verification. Likewise, SRECs produced by many on-site PV systems are sold to utilities or other buyers. While companies that sell their SRECs do not retain the environmental attributes of the system, such systems are still counted for the report. The decision to deploy an on-site solar installation is an essential step in solar market development.

If you see an error or omission, please email [email protected]. Please direct all press inquiries to Ken Johnson ([email protected]) or Rosalind Jackson ([email protected]).

About SEIA

Established in 1974, the Solar Energy Industries Association® is the national trade association of the U.S. solar energy industry. Through advocacy and education, SEIA and its 1,000 member companies are building a strong solar industry to power America. As the voice of the industry, SEIA works to make solar a mainstream and significant energy source by expanding markets, removing market barriers, strengthening the industry and educating the public on the benefits of solar energy. www.seia.org

About Vote Solar

Vote Solar is a non-profit grassroots organization working to fight climate change and foster economic opportunity by bringing solar energy into the mainstream. Since 2002, Vote Solar has engaged in state, local and federal advocacy campaigns to remove regulatory barriers and implement key policies needed to bring solar to scale

[1] A megawatt (MW) of solar photovoltaic (PV) capacity can, on average, supply all the annual electricity for about 160 typical American households. For more, see http://www.seia.org/policy/solar-technology/photovoltaic-solar-electric/whats-megawatt

[2] SEIA and GTM Research, Solar Market Insight: Q2 2013

[3] Fortune 100; June 2013

[4] SEIA and VoteSolar, Solar Means Business 2012