Solar Developers Get a Breath of Certainty with New Commence Construction Guidance

Tuesday, Jun 26 2018

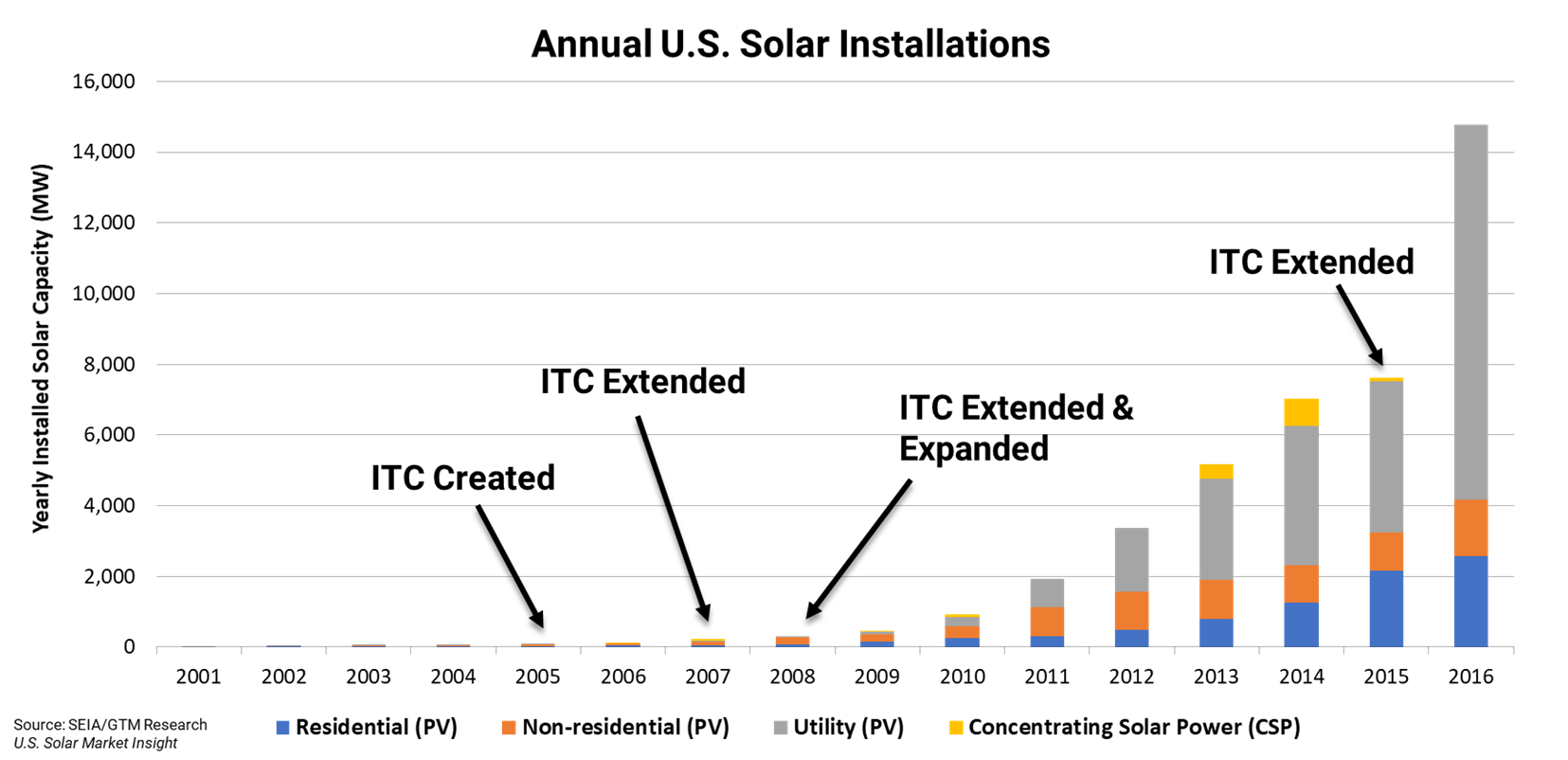

Since its historic extension in late 2015, the solar Investment Tax Credit (ITC) has been a critical mechanism for the rapid growth of solar power in the United States. The only thing missing was clear rules for when solar projects in development begin to qualify for the credit. That clarity finally came last Friday when the IRS released crucial ‘commence construction’ guidance establishing rules for ITC qualification.

After years of uncertainty, this guidance definitively states that if a solar project meets one of two thresholds by an end-of-year deadline, it can still qualify for the credit current in that year.

Those two thresholds that a solar project can meet to qualify for the ITC include: (1) starting physical work of a significant nature or (2) meeting the ‘five percent safe harbor test’ (i.e., paying or incurring five percent or more of the total cost of the facility in the year that construction begins).

At the start of 2020, the 30 percent ITC reduces to 26 percent, ramping down to 22 percent in 2021 and finally to a flat 10 percent for commercial projects in 2022 and beyond. If a project meets one of the two qualifiers from the new IRS guidance by the end of 2019 or other end-of-year ramp down deadlines, it is eligible for that current ITC rate.

That is the certainty that developers and financiers needed. Tax equity partners were growing cautious about project risk as the end of 2019 drew closer, but now, thanks to tireless advocacy from SEIA, our members and congressional supporters, that risk is mitigated.

The U.S. solar industry is one of the fastest-growing industries in the U.S., employing more than 250,000 Americans and accounting for about two percent of America’s electricity generation. This ‘commence construction’ guidance is essential to the development of current and future solar projects and can help continue the historic growth of the industry.

Do you have questions or want to learn more about the new guidance? SEIA is hosting a webinar to answer those questions and provide more detail this Thursday, June 28th at 2:00pm ET. The informative webinar will offer a review and expert analysis of the newly-published guidance and explain how it will impact the industry and your business. Click here to register now!