Solar Means Business 2017

Tracking Corporate Solar Adoption in the U.S.

Key Findings:

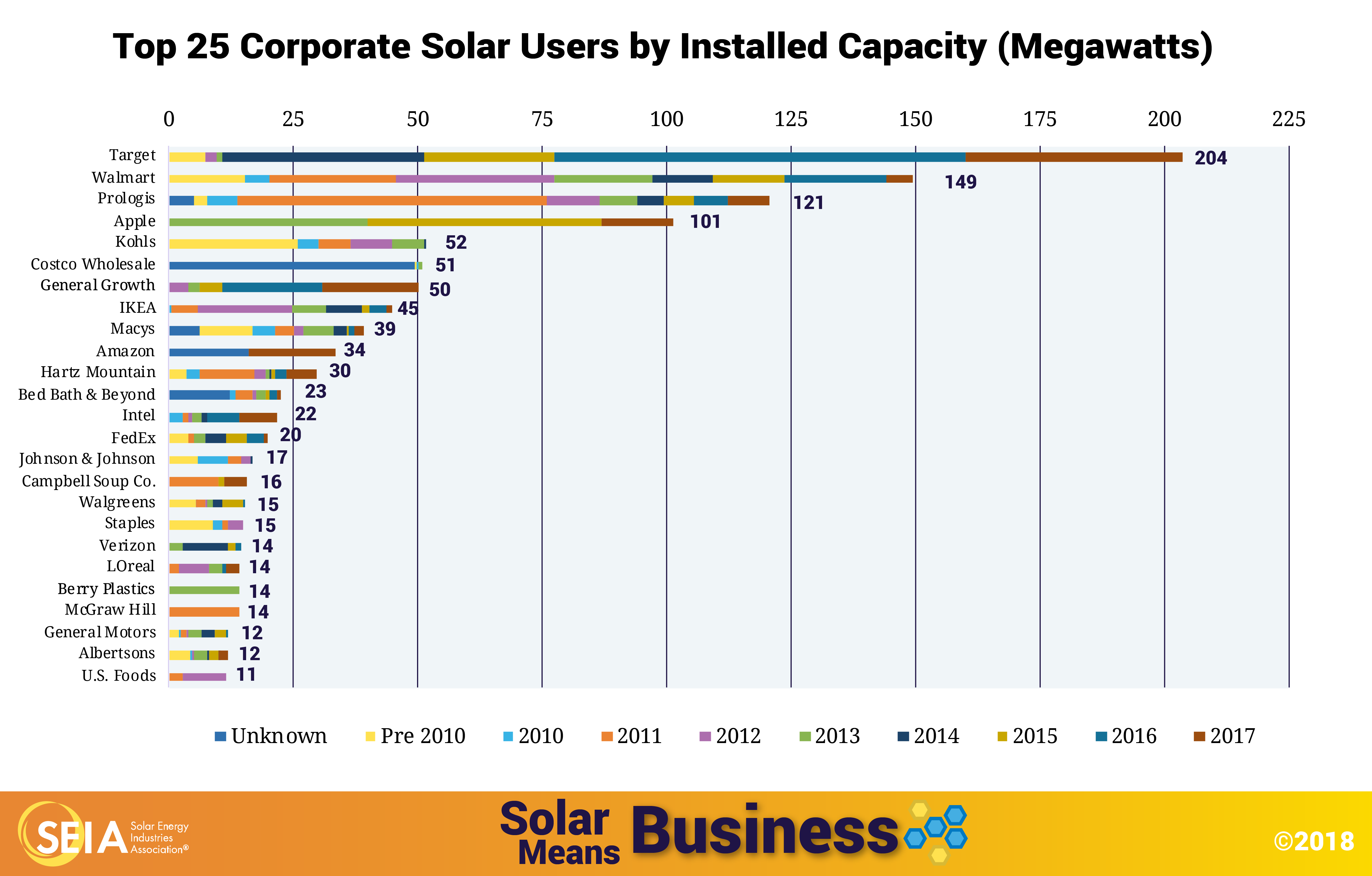

- Each of the top 3 companies held on to their 2016 positions, but each with significant additions:

- Target: 203.5 Megawatts (MW) (up from 147.5 MW in 2016 report)

- Walmart: 149.4 MW (up from 145 MW in 2016 report)

- Prologis: 120.7 MW (up from 108 MW in 2016 report)

- 2017 was the 3rd-largest year for installations by America’s top companies, with 325 MW installed. Growth was led primarily by falling costs and changes to incentive programs in key states.

- 2017 grew 2% over 2016, and 43% over 2015

- Solar Means Business database has expanded as installations grow, companies take greater interest in making data available and research methods improve

- Now tracking 2,562 MW of commercial projects across nearly 7,400 project sites and representing more than 4,000 companies

- Up from 1,092 MW and 1,947 project sites in the 2016 report

- The systems tracked in this report generate 3.2 million megawatt hours of electricity each year, enough to power 402,000 homes and offset 2.4 million metric tons of CO2 annually

- While commercial adoption has increased generally, we are seeing increased procurement of large off-site projects, which are not tracked in this report. These projects allow companies to offset a bigger portion of their electricity use - which is of growing importance to tech firms like Microsoft, Apple, Facebook and Amazon Web Services

About this Report:

- Solar Means Business tracks solar adoption by companies at U.S. facilities

- The report focuses on America’s largest companies, but includes available data for companies of all sizes

- Report covers systems installed by the end of 2017

- 6th annual edition of this report

- This report does not represent a comprehensive look at all commercial solar activity in the U.S. Instead, this report focuses on on-site solar installations at the country’s largest and most recognizable companies

- Report based on system-level data for nearly 7,400 systems

- Data in this report captures roughly 22% of all 2017 commercial solar activity

- Report does not include data for most off-site solar installations, which have grown in number in recent years (31 currently in operation according to GTM Research). The multi-party nature of many of these projects makes it difficult to assign project specifics (solar capacity amounts, environmental attributes, etc.) to certain companies.

- Data comes from a variety of sources:

- Directly from the system owners

- From installers, with permission of system owners

- From publicly available data sources such as state regulatory bodies

- All data in this report can be cited to SEIA Solar Means Business 2017 unless otherwise noted

Click here to download a PDF of the 2017 Solar Means Business Report